As a reader of The Deep Woods, I suspect you understand that while I am a man of calculation and principle, I am also one to live life to the fullest and embrace the challenges that have that the chance to reap reward. So, when I say, “let’s wing it,” there is potential reward to be reaped.

The world-renowned theoretical physicist, Albert Einstein, once said, “Strive not to be a success, but rather of value.” I understand this sentiment and so do “fallen” angel bonds.

The term fallen angel is used to christen bonds of companies that were once rated investment-grade but have been downgraded to “junk” status. Often, these downgrades tend to result in forced selling by investors who cannot hold sub-investment-grade debt, which, in turn, suppresses the bond’s price.

So, going back to Einstein’s quote, these fallen angels have targeted the former part of the quote quite nicely. To focus on the latter part, let’s talk about what gives our fallen friends value. While the bond itself has been downgraded, it still holds qualities that once made it a success.

A 2019 report by The Chartered Alternative Investment Analyst Association (CAIA) found that bonds entering a fallen angels index are priced 150 basis points cheaper than high-yield peers, on average. This, combined with their higher credit quality than typical high-yield bond portfolios, makes them of potential value for fixed-income investors, as a portfolio of these bonds offer upside potential and less credit risk than most high-yield peers.

Now, it’s time to wing it and discuss one exchange-traded fund (ETF) that offers investors exposure to these fallen angels – the iShares Fallen Angels High Yield Corp Bond UCITS ETF (WING). Before we dig any further into this fund, and before any due diligence is done on my readers’ part, this ETF trades under multiple symbols including, QDVQ.DE and WIAU.L, which are the international symbols, as it trades on various indexes.

This ETF tracks the Bloomberg US HY Fallen Angel 3% Capped Index and offers physical exposure to bonds from developed-market issues whose credit ratings have recently fallen from investment-grade status. Currently, the fund offers exposure to 158 holdings that are primarily in the consumer cyclical, consumer non-cyclical and communications sectors. The fund’s goal is to exploit the underpricing of these downgraded bonds with the hope that the price appreciates as the market for each bond stabilizes.

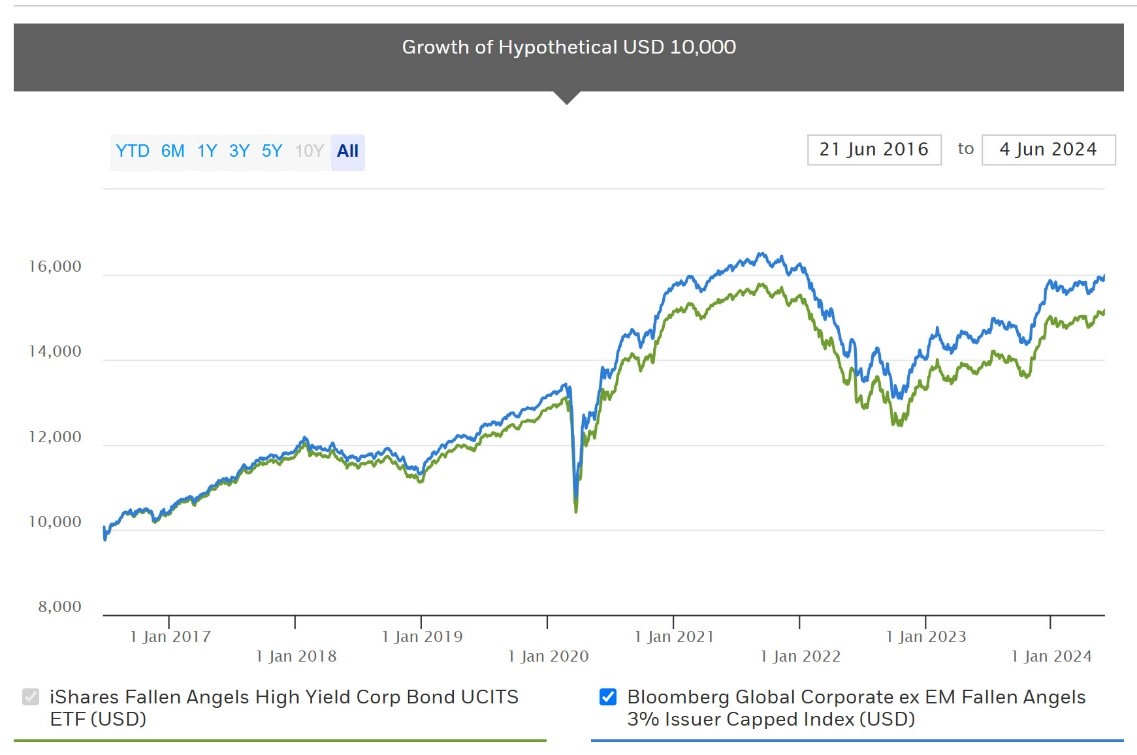

Since the fund’s 2016 inception, it has seen a 6.1% annualized return, which is two percentage points better than the high-yield category norm and over five percentage points better than the Morningstar U.S. Core Bond Index, according to Morningstar.com. Further, the fund has over $900 million in net assets and more than $400 million in assets under management. It further offers a dividend yield of 5.42%.

Now, I would be remiss in my writing if I did not warn my readers of the potential drawbacks to this fund. Because WING often adds to its portfolio during volatile price action, the fund itself may be riskier than those in the investment-grade universe and other high-yield funds not in the fallen-angel sphere.

As you can see from the chart below, while it is always smart to be aware of all facets of a fund, this one has continued its growth journey from its inception. While there was a sharp dip in 2020, WING found its footing quickly and has since performed well.

Ultimately, fallen angel bonds have the potential to be high-risk, high-reward vehicles for savvy investors. However, for investors looking for a fund of this nature, iShares Fallen Angels High Yield Corp Bond UCITS ETF may be a sturdy bet. It offers a handsome dividend yield, diverse physical exposure to 158 holdings and more than enough assets to keep itself afloat.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to email me. You may see your question answered in a future ETF Talk.

On a final note, if nothing else, I have answered a question that the band Aerosmith has had since 1997. In a song titled “Fallen Angels,” one question remained, “Where do the fallen angels go?” The answer? Into exchange-traded funds with the goal of rewarding brave investors.